Home Equity

-

A Guide to Using a HELOC for Home Improvements

Homeowners often find themselves with a variety of home improvement projects that they wish to undertake, from small repairs to major renovations. Funding these projects can be a challenge, but a Home Equity Line of Credit (HELOC) can be a useful financial tool. This guide provides an in-depth look at how to effectively use a […]

February 7, 2025 -

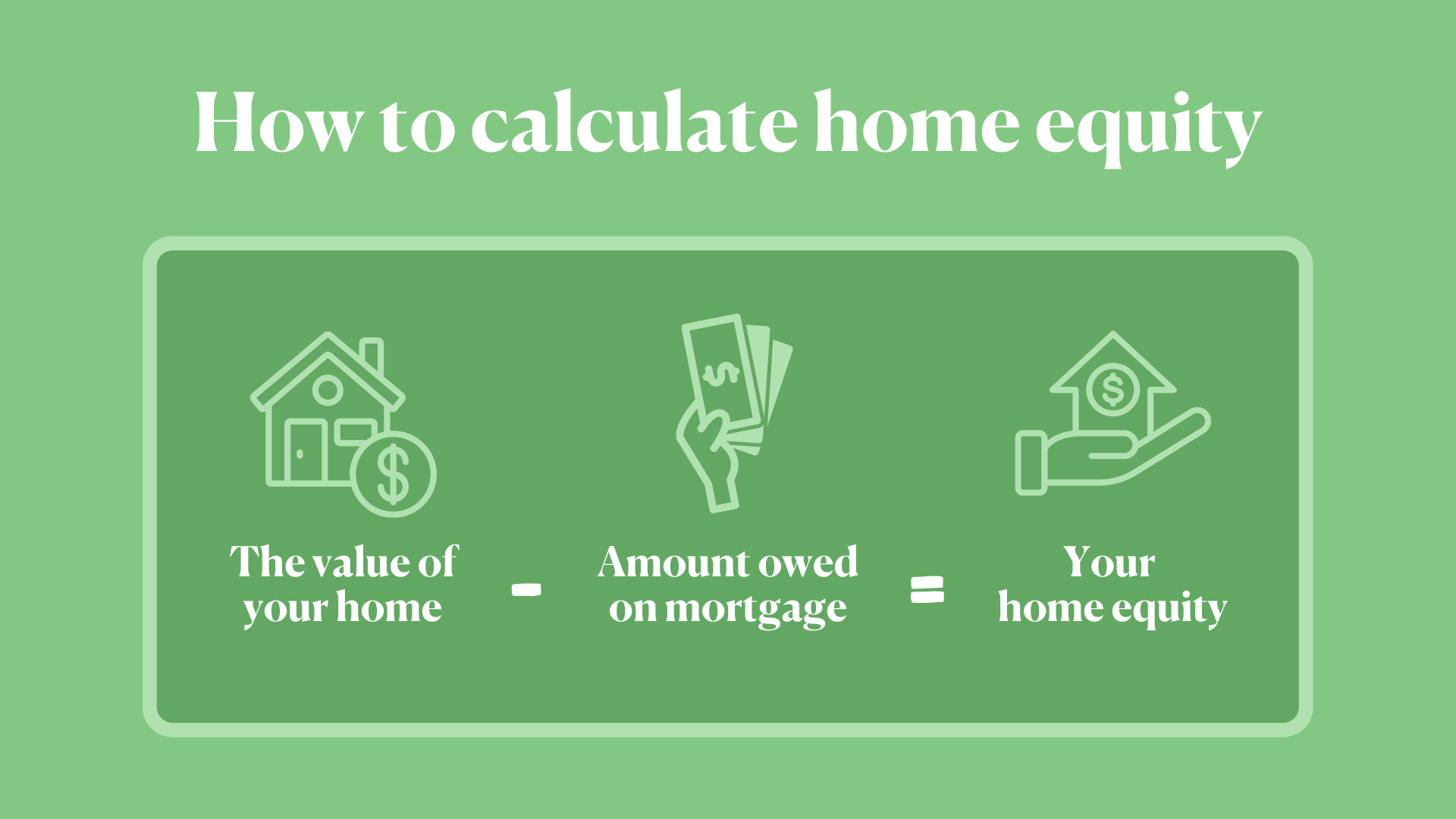

How to Calculate Your Home Equity: A Step-by-Step Guide

Introduction Understanding your home equity is essential for making informed financial decisions. Home equity represents the portion of your property that you truly own, and it can be a valuable asset for funding various expenses, from home improvements to debt consolidation. In this comprehensive guide, we’ll walk you through the process of calculating your home […]

February 9, 2025 -

How to Use Home Equity to Fund Major Purchases: A Comprehensive Guide

Introduction Home equity is a powerful financial tool that can help you fund major purchases without relying on high-interest credit cards or personal loans. By leveraging the value of your home, you can access significant funds at relatively low interest rates. In this comprehensive guide, we’ll explore the various ways to use home equity, the […]

February 9, 2025 -

Is a HELOC Available for an Investment Property?

Home Equity Lines of Credit (HELOCs) are popular financial tools that allow homeowners to access the equity in their primary residences. However, many real estate investors wonder if they can leverage a HELOC for their investment properties. This comprehensive guide will provide accurate information, practical tips, and clear guidance on whether a HELOC is available […]

February 6, 2025 -

Are HELOCs Transfer and Withdrawal Instant?

Home Equity Lines of Credit (HELOCs) are a popular financial tool for homeowners looking to leverage the equity in their homes. HELOCs provide a flexible line of credit that can be used for various purposes, such as home improvements, debt consolidation, or major purchases. One of the key benefits of a HELOC is the ability […]

February 7, 2025 -

How to get a home equity loan with high DTI

Understanding Debt-to-Income Ratio Before diving into the process of obtaining a home equity loan with a high debt-to-income (DTI) ratio, it’s important to understand what DTI is and why it matters. The DTI ratio measures your monthly debt payments against your gross monthly income. It’s a critical factor lenders consider when assessing your ability to […]

February 7, 2025 -

How to Maximize Your Home Equity with Smart Financial Planning

Introduction Home equity is one of the most powerful financial assets you can build as a homeowner. By strategically managing your home equity, you can leverage it for various financial goals, from home improvements to retirement planning. In this article, we’ll explore how to maximize your home equity through smart financial planning. Understanding Home Equity […]

February 9, 2025 -

Can I get a home equity loan without an appraisal?

Home equity loans are a popular financing option for homeowners looking to leverage the equity in their homes for various purposes, such as home improvements, debt consolidation, or major purchases. One common requirement when applying for a home equity loan is a home appraisal, which determines the current market value of your property. However, many […]

February 7, 2025 -

Do You Lose Home Equity When You Refinance?

Refinancing your mortgage can be a strategic move to secure better loan terms, reduce monthly payments, or access home equity. However, it’s natural to wonder whether refinancing might impact the equity you’ve built in your home. This comprehensive guide will provide accurate information, practical tips, and a clear understanding of how refinancing affects home equity, […]

February 6, 2025 -

How is Interest Calculated on a HELOC?

Introduction When homeowners consider a Home Equity Line of Credit (HELOC), understanding how interest is calculated is crucial. This article will delve into the intricacies of HELOC interest calculation, providing valuable tips and guidance for those considering this financial tool. Understanding HELOC What is a HELOC? A Home Equity Line of Credit (HELOC) is a […]

February 7, 2025

- « Previous

- 1

- 2

- 3

- 4